Your Table mat gst rate images are ready in this website. Table mat gst rate are a topic that is being searched for and liked by netizens today. You can Get the Table mat gst rate files here. Download all free photos.

If you’re searching for table mat gst rate images information related to the table mat gst rate keyword, you have visit the ideal site. Our website always provides you with hints for seeing the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

Table Mat Gst Rate. The GST Council revises the rate slab of goods and services on a periodic basis. Commonly used Goods and Services at 5 Standard Goods and Services fall under 1st slab at 12 Standard Goods and Services fall under 2nd Slab at 18 and Special category of Goods and Services including luxury. Iron Or Steel Wool. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron.

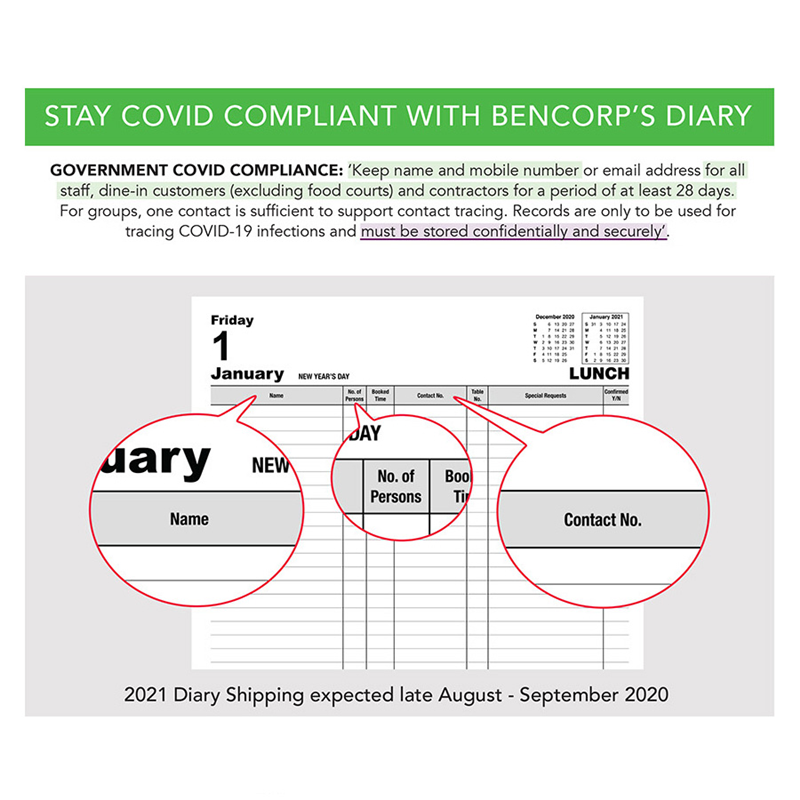

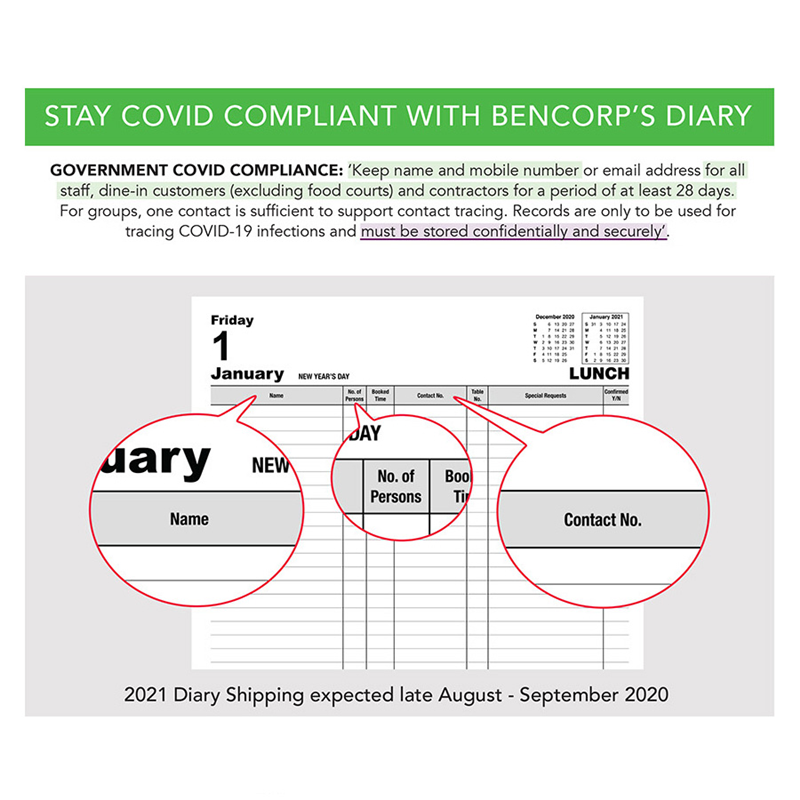

Hospitality And Washroom Supplies In Australia From bencorp.com.au

Hospitality And Washroom Supplies In Australia From bencorp.com.au

Tax rates are sourced from GST website and are updated from time to time. GST rates for all HS codes. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description. You have to only type name or few words or products and our server will search details for you. Attend our GST webinar to help you to understand GST and its implications for business. Table kitchen or other household articles of aluminium.

The GST rates are usually high for luxury supplies and low for essential needs.

112017-Central Tax Rate dated 28th June 2017 GSR. Tax rates are sourced from GST website and are updated from time to time. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description. Supplies subject to GST at the rate of 10 - are made if a supply is for consideration made in the course of continuing an enterprise connected with Australia and the supply is neither GST-free or input taxed. Capital gains tax 28000 42 100 11760 Goods and services tax The goods and services tax GST is a tax of 10 which is added to the price of most goods including cars and services such as insurance. 112017-Central Tax Rate dated 28th June 2017 GSR.

Source: researchgate.net

Source: researchgate.net

The GST rates are usually high for luxury supplies and low for essential needs. The GST-exclusive price of the product is 9091. The GST amount on the product is 909. 57021000 Kelem Schumacks Karamanie and similar hand-woven rugs. The GST Council revises the rate slab of goods and services on a periodic basis.

Source: bannerbuzz.com.au

Source: bannerbuzz.com.au

You are adviced to double check rates with GST rate. Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia. Table Kitchen Or Other Household Articles And Parts Thereof Of Iron Or Steel. Under GST- 5 percent for essential goods standard rate of 12 and 18 percent high rate of 28 percent and peak rate of 28 percent plus cess for luxury items. If the goods specified in this entry are supplied by a supplier along with supplies of other goods and services one of which being a taxable service specified in the entry at S.

Source: howtoexportimport.com

Source: howtoexportimport.com

Iron Or Steel Wool. Attend our GST webinar to help you to understand GST and its implications for business. The GST Council revises the rate slab of goods and services on a periodic basis. To work out the cost including GST you multiply the amount exclusive of GST by 11. 13 11 6 3.

Source: aubsp.com

Source: aubsp.com

GST rates for all HS codes. GST rates for all HS codes. Table of Contents Page 1. If the goods specified in this entry are supplied by a supplier along with supplies of other goods and services one of which being a taxable service specified in the entry at S. 690E the value of supply of goods for the purposes of this entry shall be deemed as.

Source: in.pinterest.com

Source: in.pinterest.com

Established in the year 1987 at New Delhi India we Kapoor Plastic Agencies are Sole Proprietorship based firm involved in the manufacturing of Table Sheet Table Cover Bed Sheet Kitchen Roll Table Mat and PVC ClothAlong with this our reliability in business practices timely completion of the undertaken consignment orders and reasonable prices have enabled us gaining the trust of. Iron Or Steel Wool. The most essential goods and services attract nil rate of GST under Exempted Categories. A taxable sale must be. They are 5 GST 12 GST 18 GST 28 GST.

Source: researchgate.net

Source: researchgate.net

100 divided by 11 909. Iron Or Steel Wool. Barbers chairs and similar chairs having rotating as well as both reclining and elevating mo Hs Code. Example 3 Calculating GST a If the cost of electricity supplied in one quarter is 28850 how much GST will be added to the bill. Table of Contents Page 1.

Source: in.pinterest.com

Source: in.pinterest.com

Table Kitchen Or Other Household Articles And Parts Thereof Of Iron Or Steel. 9402 Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs. The GST rate slabs are decided by the GST Council. Table kitchen or other household articles of aluminium. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description.

Source: in.pinterest.com

Source: in.pinterest.com

You can search GST tax rate for all products in this search box. Example 3 Calculating GST a If the cost of electricity supplied in one quarter is 28850 how much GST will be added to the bill. Capital gains tax 28000 42 100 11760 Goods and services tax The goods and services tax GST is a tax of 10 which is added to the price of most goods including cars and services such as insurance. To work out the cost including GST you multiply the amount exclusive of GST by 11. Iron Or Steel Wool.

Source: bencorp.com.au

Source: bencorp.com.au

Supplies subject to GST at the rate of 10 - are made if a supply is for consideration made in the course of continuing an enterprise connected with Australia and the supply is neither GST-free or input taxed. Commonly used Goods and Services at 5 Standard Goods and Services fall under 1st slab at 12 Standard Goods and Services fall under 2nd Slab at 18 and Special category of Goods and Services including luxury. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron. Table kitchen or other household articles of aluminium. To calculate the GST on the product we will first calculate the amount of GST included then multiply that figure by 10 The GST rate.

Source: pinterest.com

Source: pinterest.com

5702 CARPETS AND OTHER TEXTILE FLOOR COVERINGS WOVEN NOT TUFTED OR FLOCKED WHETHER OR NOT MADE UP INCLUDING KELEM SCHUMACKS KARAMANIE AND SIMILAR HAND-WOVEN RUGS Hs Code Item Description. GST rates for all HS codes. 909 multiplied by 10 GST rate of 10 9091. Table Kitchen Or Other Household Articles And Parts Thereof Of Iron Or Steel. You divide a GST inclusive cost by 11 to work out the GST component.

Source: swiftsupplies.com.au

Source: swiftsupplies.com.au

Table kitchen or other household articles of aluminium. Capital gains tax 28000 42 100 11760 Goods and services tax The goods and services tax GST is a tax of 10 which is added to the price of most goods including cars and services such as insurance. The GST rates are usually high for luxury supplies and low for essential needs. 57021000 Kelem Schumacks Karamanie and similar hand-woven rugs. GST rates for all HS codes.

Source: tr.pinterest.com

Source: tr.pinterest.com

Capital gains tax 28000 42 100 11760 Goods and services tax The goods and services tax GST is a tax of 10 which is added to the price of most goods including cars and services such as insurance. To work out the cost including GST you multiply the amount exclusive of GST by 11. The GST rates are usually high for luxury supplies and low for essential needs. This calculator can help when youre making taxable sales only that is a sale that has 10 per cent GST in the price. The GST-exclusive price of the product is 9091.

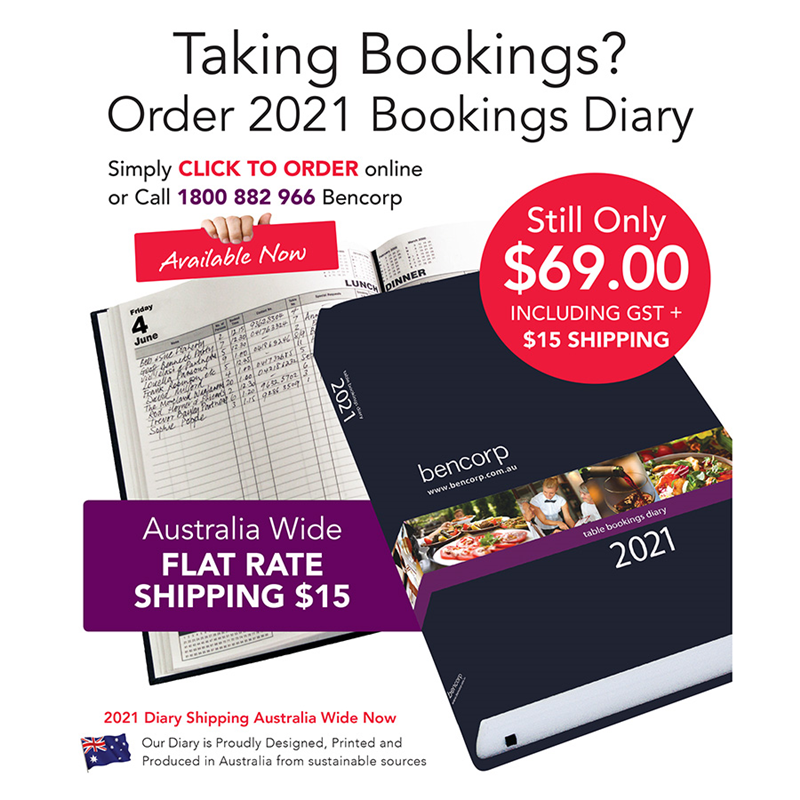

Source: bencorp.com.au

Source: bencorp.com.au

Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron. They are 5 GST 12 GST 18 GST 28 GST. We already know that the GST slabs are pegged at 5 12 18 28. A taxable sale must be. 9402 Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs.

Source: nypartyhire.com.au

Source: nypartyhire.com.au

Four main GST rate slabs framed with Essential goods and services Standard goods and services and luxury goods and services with 5 12 18 and 28 respectively. Supplies subject to GST at the rate of 10 - are made if a supply is for consideration made in the course of continuing an enterprise connected with Australia and the supply is neither GST-free or input taxed. Table Kitchen Or Other Household Articles And Parts Thereof Of Iron Or Steel. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron. A taxable sale must be.

Source: in.pinterest.com

Source: in.pinterest.com

9402 Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs. Table of Contents Page 1. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description. Supplies subject to GST at the rate of 10 - are made if a supply is for consideration made in the course of continuing an enterprise connected with Australia and the supply is neither GST-free or input taxed. 57021000 Kelem Schumacks Karamanie and similar hand-woven rugs.

Source: researchgate.net

Source: researchgate.net

Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description. You have to only type name or few words or products and our server will search details for you. 5702 CARPETS AND OTHER TEXTILE FLOOR COVERINGS WOVEN NOT TUFTED OR FLOCKED WHETHER OR NOT MADE UP INCLUDING KELEM SCHUMACKS KARAMANIE AND SIMILAR HAND-WOVEN RUGS Hs Code Item Description. Province On or after October 1 2016 July 1 2016 to September 30 2016 April 1 2013 to June 30 2016 July 1 2010 to March 31 2013 January 1 2008 to June 30 2010. 100 divided by 11 909.

Source: br.pinterest.com

Source: br.pinterest.com

Tax rates are sourced from GST website and are updated from time to time. Table of Contents Page 1. You divide a GST inclusive cost by 11 to work out the GST component. Supplies subject to GST at the rate of 10 - are made if a supply is for consideration made in the course of continuing an enterprise connected with Australia and the supply is neither GST-free or input taxed. Four main GST rate slabs framed with Essential goods and services Standard goods and services and luxury goods and services with 5 12 18 and 28 respectively.

Source: researchgate.net

Source: researchgate.net

The GST Council revises the rate slab of goods and services on a periodic basis. 13 11 6 3. Attend our GST webinar to help you to understand GST and its implications for business. You divide a GST inclusive cost by 11 to work out the GST component. Established in the year 1987 at New Delhi India we Kapoor Plastic Agencies are Sole Proprietorship based firm involved in the manufacturing of Table Sheet Table Cover Bed Sheet Kitchen Roll Table Mat and PVC ClothAlong with this our reliability in business practices timely completion of the undertaken consignment orders and reasonable prices have enabled us gaining the trust of.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title table mat gst rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.